Airlines are facing an anxious wait for this year’s summer season in Europe as concerned consumers hold off from booking their holidays due to the uncertain global climate.

A mixture of an unstable world geopolitically thanks to the return of President Trump in the US and increasing concerns about summer heat in the Mediterranean are already shaping consumer thinking for the forthcoming peak season.

The results can be seen in aviation analysts OAG data which shows there are a total of 947.16 million seats scheduled for departure in Europe for the summer season between the last weekends in March and October, just 3 per cent more than in 2024.

OAG partner John Grant says: “It’s not a matter of capacity this summer; it’s a matter of demand. In some countries demand is going to fall and airfares are going to fall and airlines aren’t going to make as much profit as they previously did.

“It’s far too late for airlines to be significantly adjusting their schedules for the summer programme; from a schedules perspective we are in a period of anticipation and we’ll see what happens to demand.”

Sven Carlson Aviation Consulting managing director Carl Denton agrees this summer has seen airlines exercise more caution as to what routes to operate as consumers increasingly book later.

He says: “Aviation capacity in Europe was a little bit overcooked last year in certain parts and from a leisure perspective there certainly wasn’t a perception that there was a constraint on capacity.

“Pricing was very aggressive last year and that has led to some changes this year with certain airlines cutting back capacity.

“There was too much competition on the routes and they’re just not prepared to take a hit on the yield so they have scaled down.”

So which European markets have been worst hit by the cutting back of available departure seats? For obvious reasons thanks to the ongoing invasion of Ukraine, the Russian Federation has been worst hit, with 46.8 million seats available this summer, down 3.65 million last year.

Elsewhere, most of Europe has recorded single-digit growth in scheduled seat departures except for Scandinavia where seat numbers are down overall.

The region’s biggest market Norway has shrunk from 2024 with 22.36 million seats to 22.23 million this year, while Sweden has fallen from 14.12 million to 13.85 million in the same period.

Denmark has also suffered a fall from 14.71 million departing seats last summer to 14.44 million for 2025 while only Finland has recorded some growth, up from 7.45 million in 2024 to 7.81 million this summer.

Spanish volume

Elsewhere, Spain remains Europe’s largest aviation market with 117.91 million departure seats and the same number of arrivals, up from 114.26 million in 2024.

While Spain might have aspirations to take France’s crown as Europe’s most visited destination, and which has 72.53 million arriving seats this summer, Grant says growth in airline seats in Spain is as much driven by its geography and government as its popularity as a holiday destination.

He adds: “France doesn’t support its aviation industry, Spain does. France doesn’t have the Canaries and the Balearic islands, Spain does, and they are alone are huge domestic markets.”

Elsewhere, Denton predicts that Turkey is unlikely to see the same success as last year, despite OAG data showing 89.07 million seats are scheduled to arrive there this summer, an increase of 5.9 per cent year on year.

He adds: “Last year hotel beds were incredibly cheap, the lira was very weak and hotel beds were purchased in sterling to get the benefit of the exchange rate (for the UK market). All the things were pointing in the right direction for Turkey.

“However, this year inflation has hit the roof in Turkey and hoteliers have got greedy with hotel prices going up a minimum of 10 per cent so the exact opposite is happening. All of a sudden it is hard to sell Turkey.”

Ryanair and the OTAs

Denton also argues that online travel agents (OTAs) will no longer be able to bail out the destination after many of Europe’s biggest, ranging from Expedia to lastminute.com, have signed deals with Ryanair.

He adds: “OTAs don’t have any control over airline schedules but sell where the seats are available and last year there were lots of seats to Turkey and there was an abundance of seat capacity.

“This year all of the OTAs have jumped into bed with Ryanair so effectively they can sell more Ryanair stock to destinations that are more popular like Spain.”

While Spain’s schedules are the busiest, the European Travel Commission (ETC), which represents Europe’s national tourism boards, has put out a warning that Europeans are becoming increasingly wary of the extreme summer temperatures recently recorded in the Mediterranean.

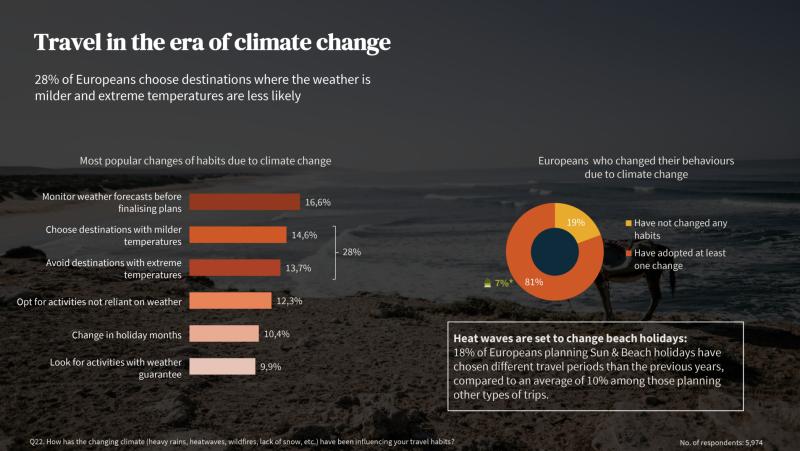

New research released by the ETC shows that 81 per cent of Europeans are considering the changing climate when choosing where to go, 7 per cent more than in 2024.

A further 17 per cent are monitoring weather forecasts more carefully, 15 per cent are actively seeking milder climates and 14 per cent are avoiding destinations prone to extreme heat.

Doubts are also emerging as to what impact American travellers will have on Europe this summer in the wake of the Trump presidency and the chaos he has unleashed on the world, most recently with his ever-changing tariff regime.

OAG data shows there are just 1.1 million more seats scheduled to arrive in Europe this summer, taking the total to 32.93 million.

Grant argues that it is the trans-Atlantic market that is most likely to see fare cuts to stimulate demand, adding: “In Europe the market has not really been impacted by Trump’s tariffs that’s not going to change much; it’s more in the north American market and transatlantic market that we might see some softening of yields.”

Certainly figures released by the US National Travel and Tourism Office show that Europeans are already avoiding the country with a 7 per cent fall in visitor numbers already seen in the first quarter of 2025.

Denton agrees that the US is increasingly being viewed by Europeans as an unwelcoming destination, despite the fact that the dollar has fallen heavily against both the pound and the euro following Trump’s inauguration.

He says: “The fall in the dollar’s value is appealing to holidaymakers but it is pushing travellers into visiting countries with dollar-based economies other than the US.

“The Caribbean, Mexico, Dubai and other Middle East countries are all dollar based and they are becoming more and more attractive than the US.”

Which means the next few months remain an uncertainty for Europe’s airlines, at least until the market reveals its intentions.