After registering record hotel transaction volumes in 2024, Japan’s hospitality market is on track for another stellar year. Last year saw deals reach US$2.9 billion in the first half of 2024, climbing to around US$7.7 billion by year end – 20 percent of all real estate transactions in the country.

Hirofumi Matsunaga, director, head of Japan Hotel Advisory at Savills Japan, notes that Q1 2025 deals have already substantially beaten Q1 2024 volumes, recording an 81 percent year-on-year increase. “All signs are that it will be another strong year for Japanese hotel transactions,” he says, “with the market displaying multiple upsides.”

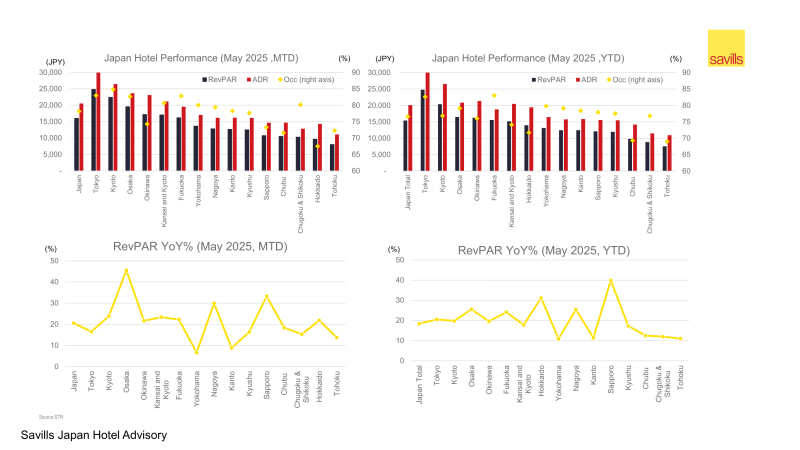

A preliminary glance at Japanese hotel performance, indeed, suggests positives all round. Last year, for example, the RevPAR in Tokyo climbed by 28 percent year-on-year, helping lift the average Japanese room increase into double-digit figures. But a glance at the numbers for May 2025 year-to-date suggest that the market is doing it again. The average y-o-y RevPAR growth for Japan is once again around 18 percent, with some outlying markets such as Osaka, host of the 2025 World Expo, registering 26 percent increases in revenue per available room.

Supply constraints

The cynical observer might think that Japan has a supply problem – but that’s not the whole story. Savills data, indeed, demonstrates that the market has been fairly efficient at adding rooms since the pandemic. There were around 942,000 rooms in Japan at the end of 2024, not including its stock of ryokan – Japanese style inns – which would bring total keys to around 1.6 million, according to Matsunaga. This is a significant improvement on the 759,000 rooms the country had in 2019. The supply curve is forecast to increase in the coming years, but it’s a graph that flattens out: while 2025 should reach 957,000 keys, the forecast suggests that the market will grow steadily up to 993,000 rooms by the end of 2029.

Land costs may have largely stabilised, but construction costs continue to climb, and Japan’s labour shortages in the hospitality sector have not been fully resolved. Furthermore, since Japanese investors have historically preferred master lease arrangements, which are mainly feasible for midscale and economy hotels, supply has tended to flood the mid-to-lower end of the market.

Luxury problem

This does little to improve Japan’s notable undersupply of upper upscale and luxury stock. The Japanese government forecasts that the country could see a record-breaking 60 million visitors by 2030, including an increasing portion of high-net-worth individuals; however, the proportion of luxury rooms is at an all-time low. The country has always been a global outlier in this area: for example, luxury rooms in Tokyo make up just 9 percent of total stock, while representing 26 percent of hotels in New York, and 15 percent in London. The UK capital also has a much larger offering of upscale and upper upscale rooms.

Several costly new luxury hotels are coming on line this year, but developers are also exploring ingenious routes to add fresh supply. Tokyo’s newest luxury hotel, the Fairmont Tokyo, which started accepting guests from July, is part of an ambitious mixed-use development in the Shibaura and Hamamatsucho area, designated under Japan’s national strategic special zone programme. Developer Nomura Real Estate Development has created the 219-key hotel in the south tower of the twin-towered scheme, which also includes residential, commercial and office components, as well as public parks and other amenities. Accor brand Fairmont is making its Japanese debut with this scheme, benefitting from Tokyo Bay views from the upper floors of the tower.

“Mixed use development in large city location helps mitigate land costs and diversify the investment risk,” notes Matsunaga.

Another Tokyo project, this time by Tokyu Corporation, Tokyu Department Store and L Catterton Real Estate, will see the former firm’s Shibuya department store demolished in favour of a boutique mixed-use scheme. This will feature a hotel to be flagged by Asian brand Swire Hotels, which is opening its first luxury hotel outside China under “The House Collective” brand. The hotel is due for completion in 2029, and will be flanked by high quality retail and rental residences as part of the Shibuya Upper West Project.

Other development routes

Branded residences may be a growing trend in Asia Pacific, but Japan is lagging most of its neighbours in terms of supply. This is likely to change in the coming years, due to the appeal of combining projects. “There are benefits of diversification where they are developed alongside a hotel,” Matsunaga notes. “Branded residence sales can ease the investment cashflow for the hotel part, making such projects increasingly interesting.”

A few projects are already in operation, such as the Park Hyatt Niseko Hanazono Residences, situated in the upscale ski resort of Niseko. Aman Residences Tokyo is the brand’s first standalone branded residence, overlooking the Tokyo tower. In Kyoto, Four Seasons has combined a hotel with a branded residences project, the latter of which has a one-bedroom unit for sale for around US$5.2 million.

Other developers are looking into Japan’s compelling resort market as a route for growth. “Wealthy inbound travellers are looking for resort stays just a few hours distance from Tokyo,” Matsunaga suggests, “which are ideally managed by well-known luxury brands.” After opening successful city hotels, such as the Four Seasons Osaka, Four Seasons is planning to launch the Four Seasons Resort and Private Residences Okinawa, on the western coast of the tropical island. Backed by Malaysia’s Berjaya Corporation, the ambitious scheme is expected to comprise more than 40 hectares of beachfront around 50 kilometres northeast of Naha International Airport. The resort will comprise 12 hectares of project area, with 120 hotel rooms, 120 residences and 40 villas. Slated to open in 2027, it represents a total development cost of US$400 million and estimated gross development value in excess of $US1 billion.

“Four Seasons Resort and Private Residences Okinawa is another iconic project in Japan for the Berjaya Group, emulating the success of Four Seasons Hotel and Residences Kyoto, which officially opened in December 2016,” says Tan Sri Dato’ Seri Vincent Tan, founder and executive chairman of Berjaya Corporation. “I am sure that with the prestigious Four Seasons branding and management, along with its strategic location in central Okinawa, the hotel will be one of the best on the island of Okinawa.”