There is little doubt that global warming is accelerating, with climate-related disasters increasing in intensity and frequency, resulting in loss of life and significant economic consequences for areas impacted.

According to the National Oceanic and Atmospheric Administration (NOAA), between 1980 -2023 an average of 8.5 climate-related disasters that exceeded $1 billion in damages occurred annually, but over the most recent five years, 2019-2023, the annual number of events was more than 20. Over the last seven years , in fact, 137 separate billion-dollar disasters have killed at least 5,500 people and cost more than $1 trillion in damages, according to Climate,gov.

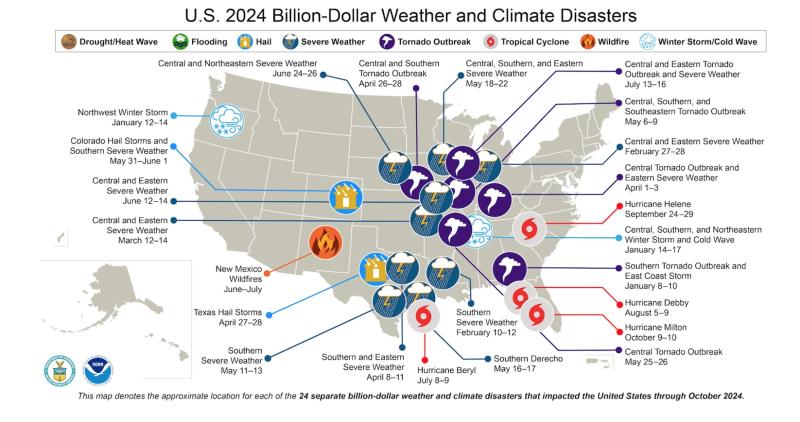

As of November 1, 2024, the United States has experienced 24 weather/climate disaster events, including four major hurricanes (Beryl, Helene, Kirk and Milton) so far, with an estimated cost of between $127 billion and $129 billion, reported USA Today. Meanwhile, there are six large wildfires burning in California, Oregon, Texas, Wyoming and New York, reported the New York Times.

How the Hurricanes Impacted Hotels

These events represent short-term and on-going impacts on the hospitality industry, with storm damage resulting in short-term or permanent loss of lodging units and lost tourism revenue, as well as higher operating costs over the long-term, particularly in regard to higher insurance premiums and property taxes.

The impact of the most recent hurricanes, Helene and Milton, on occupancy rates, property damages, and lodging policies for storm victims depended on their locations, said Fred Barnachawy, managing director who oversees the product team at Toronto, Canada-based Deshcap, a tech-driven business insurance consultant and management firm.

He noted that hotels in the Tampa region saw a surge in hotel performance due to demand by displaced residents and rescue workers during Hurricane Helene, with occupancy increasing by 24.1 percent to 81.3 percent and RevPar rising 22.1 percent to $125.29. During Hurricane Milton, however, hotels in Tampa and Orlando, which were directly affected by Hurricane Milton, experienced 9.8 percent and 5.3 percent declines in RevPAR in October, while cities hosting evacuees, like Atlanta, experienced a 20.6 percent gain in RevPar.

FEMA activated its Transitional Sheltering Assistance (TSA) Program, which covers the cost of accommodations for qualifying storm victims at participating hotels and motels. Additionally, Barnachawy noted that several hotels in affected areas offered free or discounted lodging to assist local residents seeking shelter, and Hyatt hotels supported guests and colleagues as needed, as well as waived guest cancellation fees.

Daniel Peek, president of the JLL Hotels & Hospitality Group, noted that economy, select-service, and extended-stay hotels located in noncoastal zones benefited the most by demand from displaced residents and relief workers, as they typically offer more affordable and comfortable long-stay accommodations during crises than traditional and luxury hotels and resorts.

“The first thing that happens is the hotels benefit from evacuation orders, so somewhere between core urban Tampa and Orlando and further afield, hotel occupancies picked up with people who had left their homes,” he said.

According to Peek, about a quarter of area hotels, mainly older ones, were damaged and closed—some permanently. However, hotels built under new building codes aimed at addressing resiliency in flooding, storm surges and high winds, suffered little or no damage and remained open, except those temporarily impacted by power outages, which lasted a week in some areas.

The Storms’ Silver Lining

Barnachawy said that with fewer lodging options available, the operational hotels may experience higher occupancy rates and RevPar, but the influx of guests can put a strain on resources, including staff, maintenance, and amenities. As a result, hotels will need to adapt quickly to accommodate the increase in guests, while maintaining service quality.

“The reduction in competition due to the closure of smaller hotels could allow remaining hotels to adjust pricing strategies, however, they must balance potential revenue gains with the risk of pricing out certain customer segments,” he warned.

Barnachawy also suggested that the loss of smaller, often locally owned hotels can affect the character and economy of the community. “These establishments frequently contribute to the local charm and provide affordable lodging options, and their absence may alter the tourism landscape,” he said.

“While the remaining hotels might benefit from increased occupancy and revenue opportunities, they also face challenges in scaling operations to meet the heightened demand and preserving the community’s unique hospitality offerings,” Barnachawy added.

Peek also suggested that the closing of many old beachside hotels and motels with insurmountable damage presents a rare opportunity for investors to replace them with higher uses.

Additionally, he noted hotels that were damaged and closed temporarily, such as the historic Omni Grove Park Inn in Asheville, North Carolina, and the Bilmar Beach Resort on Treasure Island in Florida, will now get upgraded to current building codes that fortify them against future storms.

North Carolina’s Long Road to Recovery

Western North Carolina, which had never been directly affected by a hurricane before, suffered damage from Hurricane Helene that will affect tourism in the area for some time to come. The region was devastated by floodwaters resulting from a deluge of rainfall prior to and during Helene, experiencing 13 -32 inches of rain across the state over the course of four days. Flooding caused rivers to overflow, dams to burst, and mudslides to bring down mountainsides and destroy major infrastructure, trapping residents in their homes and resulting in more than 100 deaths.

The region, which is situated in the Smoky Mountains, attracts millions of tourists annually, generating $7.7 billion annually in tourist revenue, about a fifth of the state’s tourist economy. All tourist attractions, including the Biltmore Estate and Village, Blue Ridge Parkway, Posgah National Forest, DuPont State Forest, Great Smoky Mountains National Park and Chimney Rock State Park as well as access to picturesque Asheville, remain closed, according to NC Newsline, a nonprofit news organization based in Raleigh, and it’s unclear when they will reopen.

The devastation came at an inopportune time, as the fall foliage season typically represents 24 percent of annual tourism visits to North Carolina, and generates $1.8 billion in visitor spending. Additionally, Asheville is a key tourist hub, and the drop in hotel occupancy will result in an estimated 40 percent decline in lodging taxes in the months following the hurricane, said Barnachawy.

But Helene not only dealt a devastating blow to Western North Carolina’s tourist industry, it shredded the region’s infrastructure, including the electric grid, water supply, and many roads. This included closing roughly a 40-mile stretch of Interstate 40 near the North Carolina-Tennessee border until sometime next year, which is causing significant disruption of travel in the region.

Despite widespread infrastructure damage, Barnachawy noted that from an investment standpoint, every hotel will perform differently depending on the effectiveness of its business interruption insurance. Similarly, he said that municipalities or counties impacted by infrastructure damage will perform differently from a budget standpoint depending on the effectiveness of its commercial insurance protecting infrastructure assets, such as cell towers.

Peek noted that big hotels will recover quickly, as they have business interruption and catastrophic damage insurance, but it will take much longer for small businesses, like the restaurants, coffee shops and small boutiques in Asheville, to recover because they don’t have these resources.

Availability and Cost of Insurance

“In response to escalating risks, some insurers are withdrawing from high-risk areas, making it challenging for property owners to obtain coverage. This trend is evident in regions prone to wildfires and hurricanes, where insurers are limiting new policy coverage or exiting the market entirely,” said Barnachawy.

Those that remain, are raising premiums significantly, added Peek, who said businesses affected by Climate events have seen their premiums escalate 20 – 50 percent.

Barnachawy noted, in fact, that the average cost of insurance for commercial real estate properties nearly doubled over the past decade, from $1,558 per building, per month in 2013 to $2,726 by the end of 2023.

He said that to reduce the cost of insurance, business owners should never buy insurance directly from a broker or agent, who is compensated by the insurer. Barnachawy contended that property owners can save a bundle in insurance costs by hiring an independent insurance consultant to tailor policy protections to client needs and negotiate premiums.

Future Insurance Outlook

Going forward, Barnachawy said that property owners also may need to implement enhanced risk mitigation strategies and explore alternative insurance solutions, as insurers reassess their exposure in high-risk regions, which may lead to further exits from these areas and continued increases in insurance rates.

This may involve enrolling in a state-operated insurance programs established to protection property owners from catastrophic events in markets where private insurance is unavailable. Currently, California offers earthquake insurance; Florida and Louisiana offer property insurance in coastal markets; and Texas, Mississippi and North Carolina provide Windstorm insurance in coastal markets to protect again wind and hail damage.

Climate Risk and Investment Decisions

Peek also noted that risk associated with Climate-related events is increasingly affecting investment decisions, particularly that of institutional investors, which are increasingly limiting their exposure in coastal areas and investing instead in hotels in core markets, like New York City, Boston, and Washington DC.

Among their concerns are the rising cost and/or availability of insurance; increasing property taxes to keep up with storm-related infrastructure damage; and declining property valuations.

A Trepp research team tracked Tampa’s key financial metrics across five real estate sectors. Property insurance and taxes in the Tampa metro area, which is one of five urban markets ranked most vulnerable to hurricanes, rose on average from $264 to $613 per unit between 2019 and 2023 and taxes rose from $571 to $679 per unit, while NOI only rose from $5,315 in 2019 to $5,577 in 2023.

The Trepp report also suggested that recurring hurricane damage presents a serious threat to property values in coastal areas, especially with storms of great severity like Helene. Commercial real estate properties in these regions may see their values decline due to the impact to cashflows or widening cap rates resulting from increased risk of damage and loss, discouraging both potential investors and tenants from buying or leasing, the report noted.

Tenants may either vacate damaged properties or seek rent reductions, particularly if they perceive continued vulnerability to future storms, the researchers wrote, pointing out that this can affect debt service coverage ratios as lower occupancy and rental income make it more difficult for property owners to meet debt obligations.

(Image courtesy of Florida National Guard/Flickr)