Corporate gatherings may not be as frequent as they once were but when they happen, they are increasingly valuable. For hotel stakeholders, many of whom pay a close eye to the meetings & events sector due to the knock-on effect on rates and occupancy, they are myriad opportunities but also risks.

With hotel trading already affected by wider economic uncertainty, M&E revenues have become a crucial lever in maintaining margins. A venue’s ability to capture higher-spending events could be the difference between outperforming peers or slipping behind. And Knight Frank’s UK Hotel Trading Performance Review and outlook for 2025 found that winners last year were those hotels which penetrated strongly in the meetings, conference and events segment.

Less is more

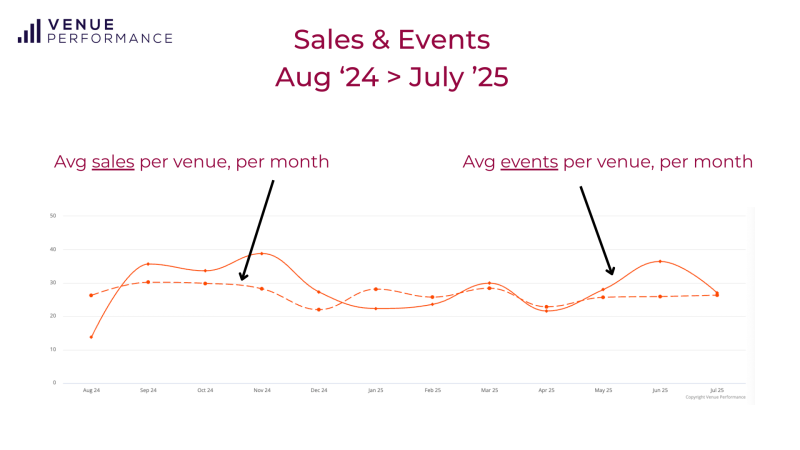

Data from benchmarking platform Venue Performance, collected from over 400 UK hotels and venues shows that overall event numbers are softening but client spend per delegate is rising. As many navigate uncertain economic waters, clients are trimming event volumes. However, when they commit, they invest generously.

“The post-pandemic exuberance where people were doing loads of events is calming down. So the number of events are going down but the revenue per delegate/the overall budget is going up,” said Peter Heath, managing director of Venue Performance.

Between January and July 2025 sales were down 3 per cent but revenue per delegate rose 8 per cent from £130.92 to £141.46, with event volumes only showing a 1 per cent rise.

The picture that emerges is one of fewer but more lucrative opportunities. Clients are consolidating budgets and focusing on impact rather than frequency. For investors, this reinforces a story of value over volume: hotels with compelling event products may achieve outsized returns even as overall demand softens.

This is as the M&E sector has nearly recovered to 2019 levels, widely regarded as a record year for UK events. As Heath observes, some operators are already reporting revenues above pre-COVID figures, others remain just shy. Heath calls it “returning to normal,” but questions linger over whether this is simply normalisation or dampening caused by economic uncertainty.

Winners and losers

What’s clear is that the winners in today’s market are not standard city-centre conference hotels. Mid-scale, uninspiring spaces are struggling to drive both volume and yield.

By contrast, country houses, estates and out-of-town venues with blank canvases and creative flexibility, wellness elements, and ESG credentials are thriving as delegates push buyers to seek out inspiring and creative environments.

“If you have a mid-market, fairly standard and uninspiring product, you’re going to struggle with volume and yield” says Heath. “If you’ve got a space where you can create experience and hit ESG numbers, you’ll do really well.”

He adds: “Event buyers have a lot of boxes to tick these days – sustainability, interactivity/creative flexibility, the food has to be top notch and the tech has to be top notch. And if as a seller of event spaces, you don't have all your processes ticked off and are able to respond really quickly, the client will just move on.”

On the topic of some of the sector’s most dynamic players, he singles out Convene, an equity-backed, tech-led operator of premium meeting spaces across London, Birmingham and Manchester as well as Village Hotels which employs an “everything-under-one-roof” model which includes gyms, Starbucks coffee outlets, pubs/F&B, accommodation and conference spaces.

Keep an eye on…

London remains the UK’s unrivalled global magnet, but escalating costs are driving some corporate business elsewhere and interest outside London is increasing. Heath notes this trend is benefiting Birmingham, Manchester, Bristol and Glasgow as he singles out Manchester as a city with “a great story which delivers culture, great transport links and a collaborative destination model where all parties come together to bring business into the city,” as he contrasts it with London’s fragmented approach.

Heath adds: “Birmingham and West Midlands saw a bump based on people seeking out destinations that weren’t London. Volumes went up and they had a really year last year as well as the beginning of this year.”

Traditional metrics like revpar no longer suffice, with Heath instead urging focus on revenue per square metre of event space and cost per delegate/head, factoring in travel, F&B and accommodation. This granular approach aligns pricing and experience and allows owners to decide whether to go for a premium product or chase headline volume with a midscale product.

Outlook

Short booking windows and shifting corporate budgets make forecasting volatile. “Post pandemic, lead times were short, expanded, and then retracted. There’s a lot of buffeting,” Heath notes. However year-to-date, they seem to be holding steady, from 81.6 to 81.7 days.

Looking just at July though, he advises caution as year-on-year comparisons show sales down 1 per cent, events down 3 per cent, delegation size down 5 per cent, and revenue per delegate down 4 per cent.

However, lead time has increased by 7 per cent YoY from 73.42 to 78.2 days, a stat which he says isn’t a warning sign but instead indicates growing confidence as clients commit to events further out, a shift away from the short-notice trends of recent years.

“In short, the market may be cooling slightly in volume, but it's heating up in scale and spend. Buyers are investing more per event and booking earlier, which bodes well for stability and strategic planning,” Heath says.

It seems the long-term trajectory is positive. The desire for in-person connection is driving sustained demand for corporate gatherings. The recovery in meetings and events is no longer just about volumes. It’s about experiences that inspire. The venues that win will not necessarily be the largest, but the most alive that deliver spaces which motivate and inspire.